capital gains tax increase 2022

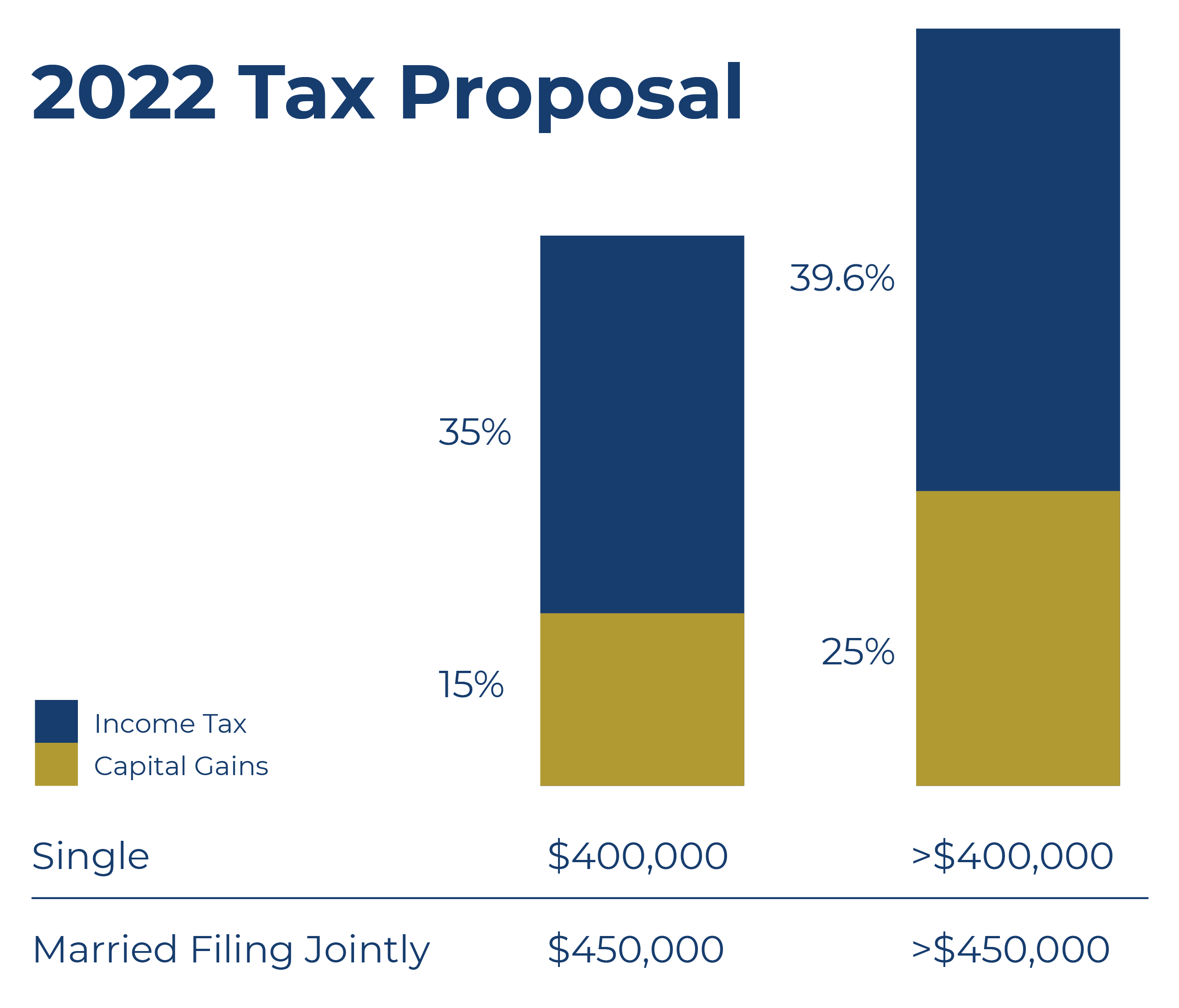

Extending expanded child tax credit through 2025. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20.

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

The new tax rates would therefore apply retroactively from.

. Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In 2023 this gift tax exclusion amount will likely increase from 16000 to 17000.

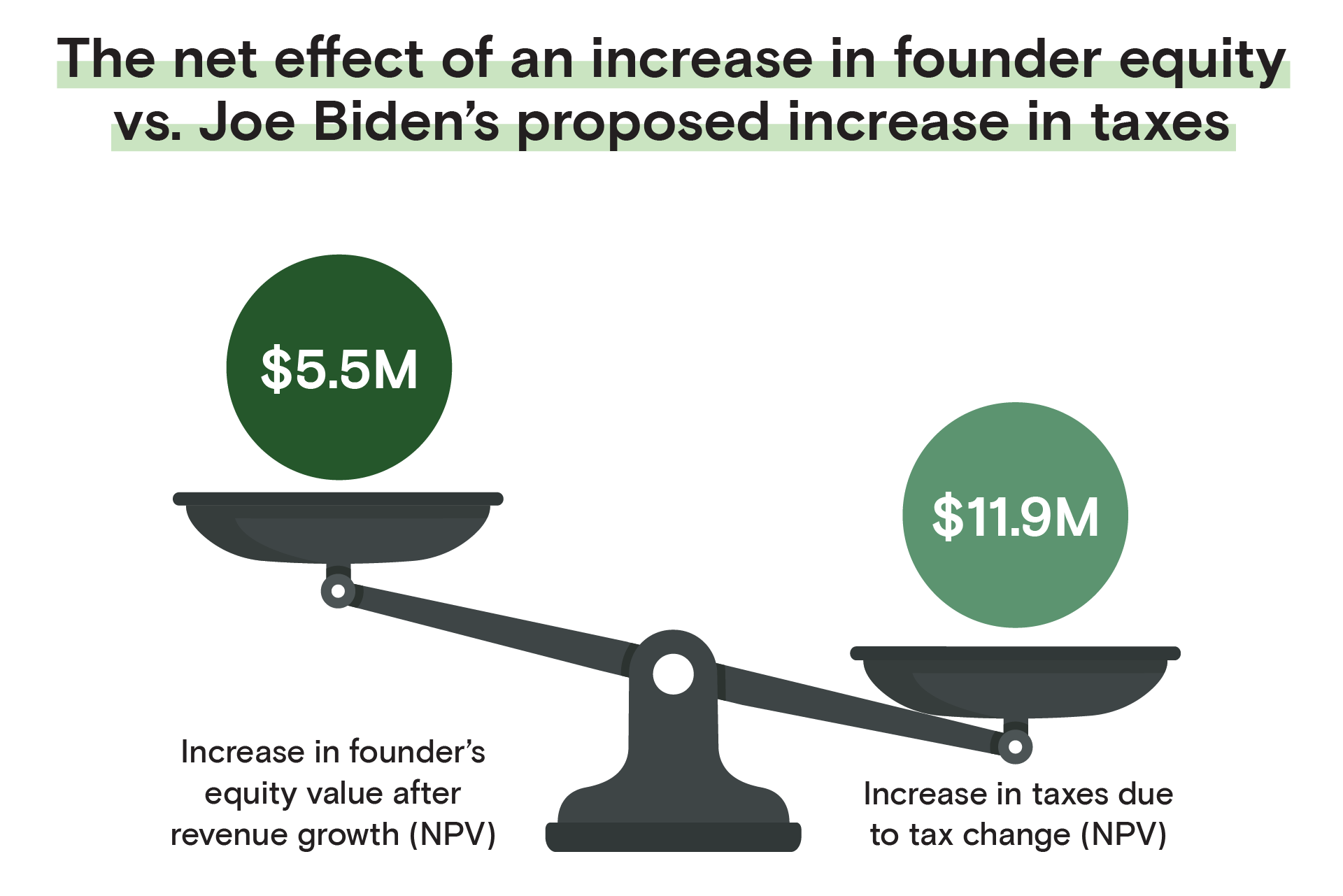

Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income. Business acquisitions accelerate in response to President Bidens plan to double the long-term capital gains tax rate for those at the top from 20 to 40. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

500000 of capital gains on real estate if youre married and filing jointly. Capital gains tax The Democrat-led state Legislature approved a 7. Unlike the long-term capital gains tax rate there is no 0.

2022 2023 Capital Gains Tax. The 2021 legislative session was a busy one in Olympia with a handful of new laws set to take effect at the start of 2022. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. It also includes income thresholds for Bidens top rate proposal and. Weve got all the 2021 and 2022 capital gains.

2021 capital gains tax calculator. The Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be. Its time to increase taxes on capital gains.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Capital Gains Tax Rates Brackets Long-term. The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year.

When you include the. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The IRS typically allows you to exclude up to.

While it technically takes effect at the start of 2022 it wont officially. 2022 capital gains tax rates. New Hampshire doesnt tax income but does tax dividends and interest.

Capital gains tax increase unlikely to deter investors. The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed.

For single tax filers you can benefit. 250000 of capital gains on real estate if youre single. The bill aims to increase the top capital gains rate AND prevent a rush to the exits while the rates are still lower.

The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from 1400 to 1500 for 2022. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The expectation of this increase resulted in a 40 increase in. When your other taxable income. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Individual Capital Gains And Dividends Taxes Tax Foundation

Impact On Jobs Tax Revenue And Economic Growth Of Proposed Tax Increase On Carried Interest Center For Capital Markets Competitiveness

How To Avoid Capital Gains Tax With A Trust Arch Legacy Firm

Short Term Capital Gains Tax Rates For 2022 Smartasset

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden S Fy2023 Budget Proposal Real Estate And Corporate Tax Increases In 2022 Windes

Testimony On Hb1507 Tax Fairness Really Means Tax Increase Grassroot Institute Of Hawaii

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax Real Estate Home Sales Rocket Mortgage

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Capital Gains And Losses Turbotax Tax Tips Videos

Short Term Capital Gains Tax Rates For 2022 Smartasset

7 Stocks That Could Benefit From A Capital Gains Tax Hike In 2022 Marketbeat

Biden Capital Gains Tax Rate Would Be Highest In Oecd

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Brief Support Fair And Simple Capital Gains Taxes