utah state solar tax credit 2019

Content updated daily for utah solar tax credit. The restc program offers a tax credit of 25 of the eligible cost of the system or 1600 until 2021.

Solar Incentives For Utah Homes Utah Energy Hub

Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit.

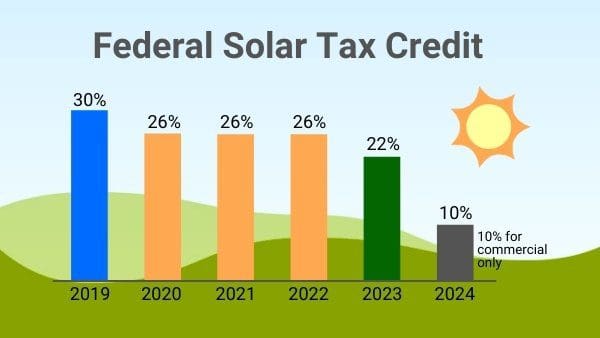

. The Utah state solar. And SALT LAKE CITY UT - The Solar Energy. In 2019 the credit is 30 percent of the system costs.

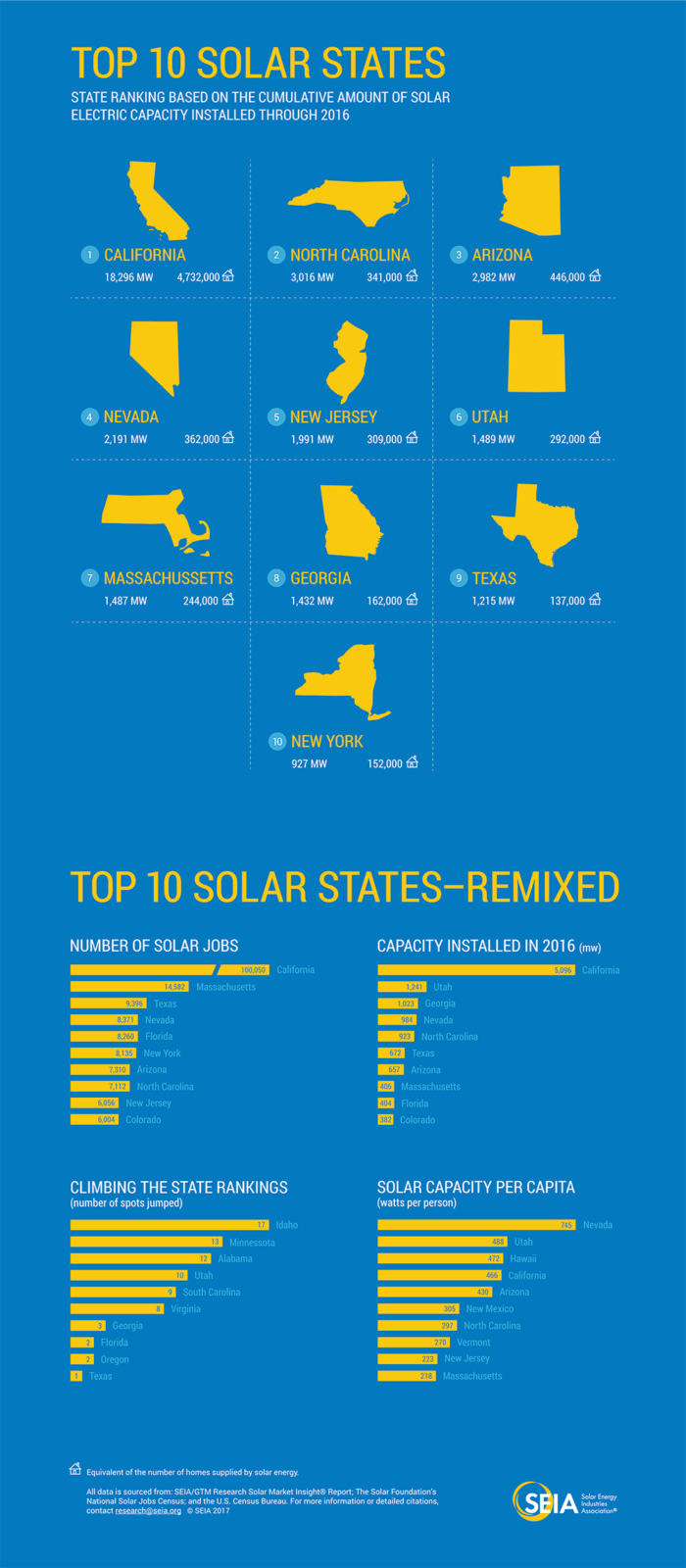

Utah is currently the 8th largest solar-state with a total of 1599 MW installed cumulatively and over 6100 solar industry employees. In 2021 the credit will be 26 percent of the system costs. In 2020 the credit will be 26 percent of the system costs.

Updates made in Energy Toolbase. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. Utah State Solar Tax Credit 2019.

State solar tax credit in Utah. Under the Amount column write in 1600. Tuesday Mar 27 2018 Utah Governor Signs New Laws Protecting Solar Consumers and Extending State Tax Credit.

This was confirmed by Governor Gary Herberts office. Utahs solar tax credit makes going solar easy. 25 capped at 800.

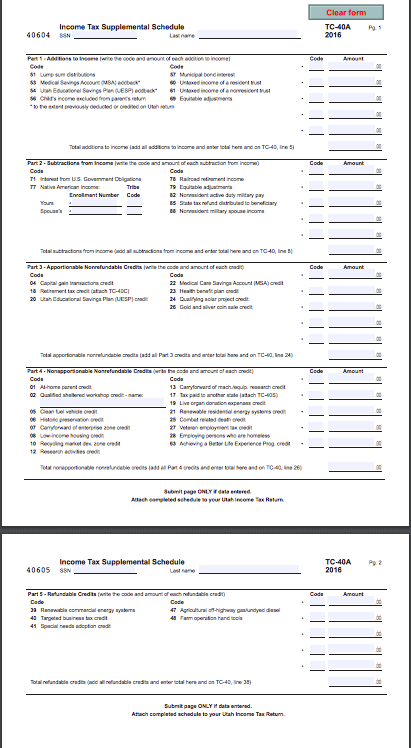

25 capped at 1200 until 123121. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. Refund of Tax Reported on.

17 Credit for Income Tax Paid to Another State. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. Here is so valuable information.

The Utah residential solar tax credit is also phasing down. As of March 2019 the Utah solar tax credit is 060 per watt based on the alternating rate schedule. The credit is for 25 of your total system cost up to a.

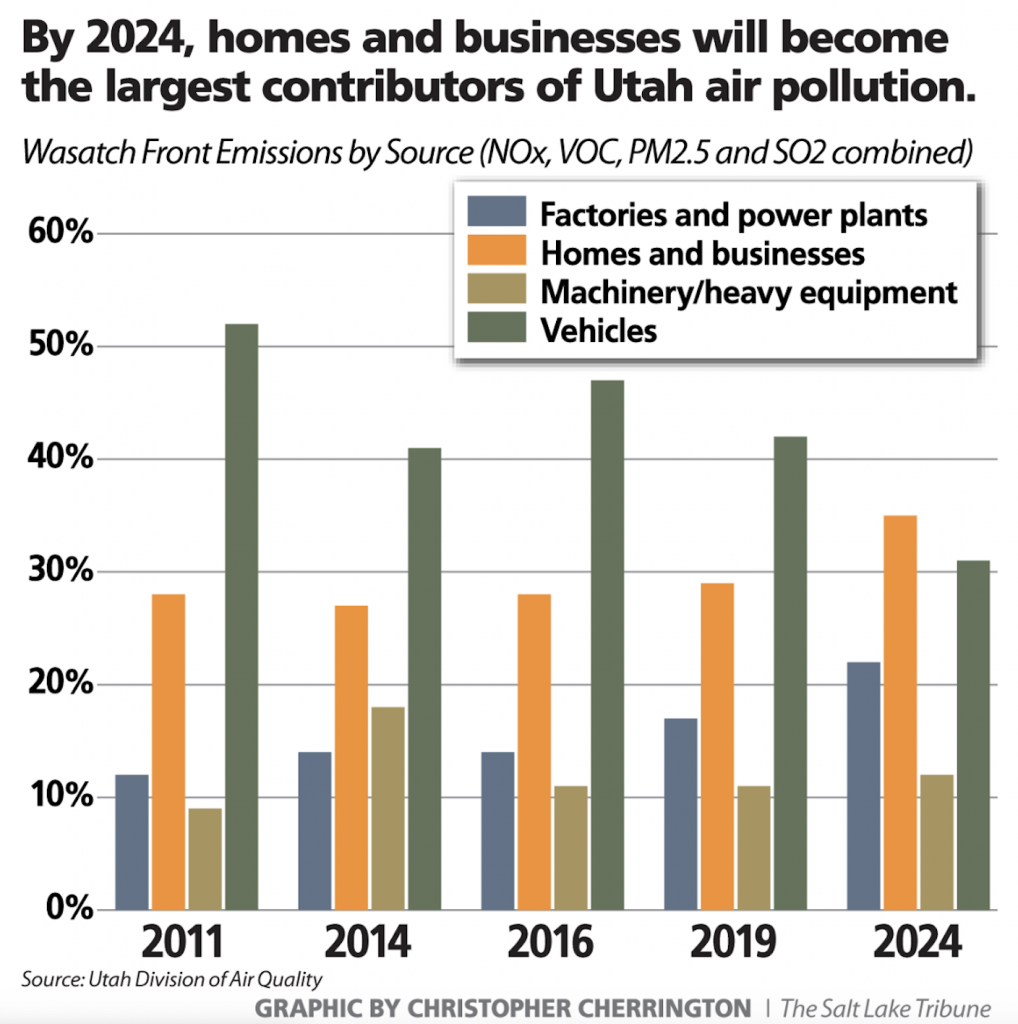

State Low-income Housing Tax Credit Allocation Certification. The cap dollar amount you can receive begins to phase down as follows. Extreme Weather Utah is known to experience extreme weather such as winter storms and blizzards.

Utahs residential electricity rates increased 26 from 2009 to 2019. 22 Utah income tax - subtract line 20 from line 10 not less than zero 22 USTC ORIGINAL FORM Utah State Tax Commission Utah Individual Income Tax Return All State Income Tax Dollars. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV.

These are the solar rebates and solar tax credits currently available in Utah according to the Database of State Incentives for Renewable Energy website. This form is provided by the Utah Housing Corporation if you qualify. 12 Credit for Increasing Research Activities in Utah.

Top Us States For Percentage Of Electricity From Solar Cleantechnica

Solar Power In The United States Wikipedia

How Community Development Tax Incentives Have Benefited Primary States Nevada Novogradac

U S Solar Project Basics Market Size And Growth Structuring The Transaction Financing The Deal

Utah S Solar Advocates Plan To Fight Decision By State Regulators

How Utah Cities Are Pursuing 100 Renewable Energy Greenbiz

The Federal Geothermal Tax Credit Your Questions Answered

Pricing Incentives Guide To Solar Panels In Hawaii 2022 Forbes Home

Cyber Attack Hits Utah Wind And Solar Energy Provider Zdnet

The 2018 State Solar Policy Changes You Need To Know Aurora Solar

Utah Solar Tax Credits Blue Raven Solar

Tangible Personal Property State Tangible Personal Property Taxes

The Federal Solar Tax Credit Explained Revised 2021

Electric Vehicles For Clean Air Utah Energy Hub

Securing The Nation S Energy Future 2019 2020 State Legislative Action